If you run a business that accepts card payments, you need to protect your customers’ data from hackers and thieves. Think of their credit card numbers as secrets that you store in a box.

PCI Compliance is the best way to secure that box and prevent anyone from snooping inside. In this post, I will tell you more about PCI Compliance and why it matters for your business.

Table of Contents

ToggleKey Highlights

- PCI compliance is essential for all businesses handling credit card information, aiming to protect cardholder data from breaches.

- Compliance involves following 12 specific requirements, including implementing firewalls, encryption, and regular security testing.

- Annual renewal of PCI compliance is required, with processes varying based on the number of transactions and business size.

- Non-compliance can result in hefty fines, loss of customer trust, and potential legal consequences.

The Basics You Must Know

Picture every time someone shops using a credit or debit card; they’re trusting the store with sensitive information. PCI compliance is a set of rules that businesses follow to ensure this trust isn’t broken.

It’s like the rules of a game that ensure no one cheats and everyone plays fair, especially when handling cardholder data.

Why Does It Matter?

- Keeps Data Safe: Like a superhero shield against villains, PCI compliance protects cardholder data from the bad guys (hackers).

- Avoids Scary Fines: Not following the rules can cost businesses a lot of money, from $5,000 to $500,000, which is no small change!

- Builds Trust: When customers know a business is PCI compliant, they feel safer shopping there, like trusting a friend with a secret.

Who Needs to Be PCI Compliant?

Any company, big or small, that accepts, processes, stores, or transmits credit card information must lock their treasure chest with PCI compliance.

It doesn’t matter how many transactions they handle; the rule applies to everyone in the game.

PCI Compliance is not a law but a contractual obligation between merchants, payment processors, and card brands. However, some countries and regions have laws that require PCI Compliance or similar standards

The 12 Requirements

Think of the PCI DSS as a treasure map with 12 specific spots to mark with an “X.” These spots range from setting up firewalls to protect the treasure, encrypting the secret codes, to regularly checking for intruders.

Here’s a simplified glimpse:

- Firewalls: Building a fortress around the treasure.

- Password Protection: Creating a secret handshake.

- Data Encryption: Turning the secret codes into a language only the rightful owner can understand.

- Anti-Virus: Keeping the bugs away that could let thieves in.

- Access Control: Making sure only those with a VIP pass can get close to the treasure.

- Regular Testing: Constantly checking for weak spots in the fortress walls.

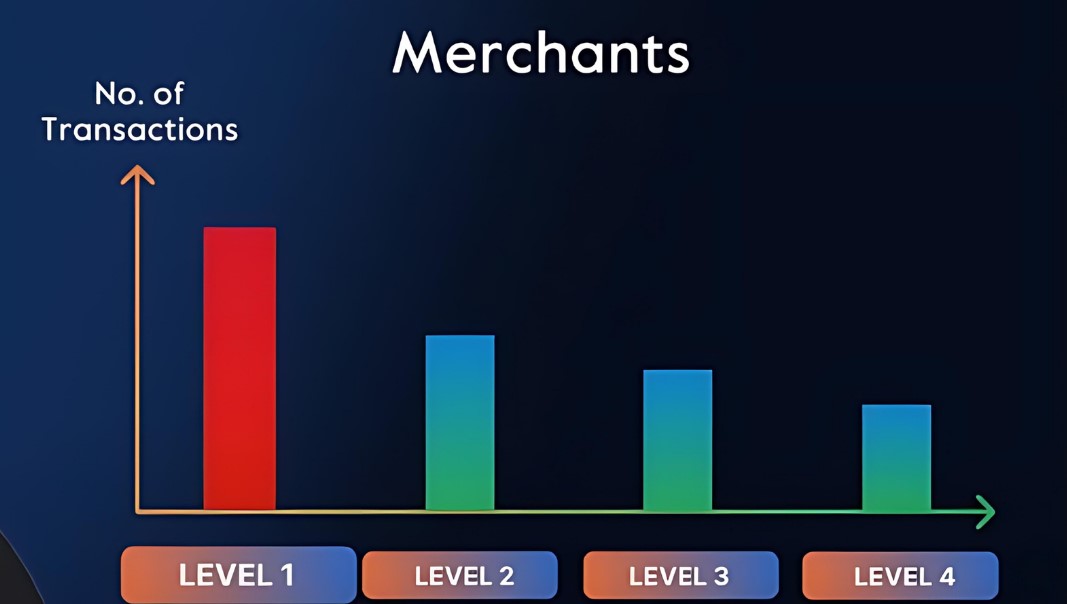

The Levels

Based on the number of transactions a business handles, they’re placed into one of four levels. The more transactions, the higher the level, and the stronger the lock needed on the treasure chest.

- Level 1: Over 6 million transactions annually.

- Level 2: 1 to 6 million transactions.

- Level 3: 20,000 to 1 million transactions.

- Level 4: Less than 20,000 transactions.

Each level has its own set of requirements, but the goal remains the same: protect the treasure.

PCI Compliance has four levels, based on the annual volume of transactions processed by a merchant. Level 1 is the highest and most rigorous, requiring an annual on-site audit and quarterly network scans. Level 4 is the lowest and most common, requiring an annual self-assessment questionnaire and quarterly network scans.

Becoming PCI Compliant

Achieving PCI compliance is a quest involving several steps:

- Understanding the Map: Knowing the 12 requirements inside out.

- Assessment: Figuring out where the treasure chest might be vulnerable.

- Fixing Weak Spots: Strengthening any weak defenses found during assessment.

- Reporting: Telling the card companies that the treasure is safe.

The Cost

While safeguarding the treasure chest isn’t free, it’s far less costly than the fines for letting the treasure get stolen.

Expenses can range from $300 to $1,000 annually for smaller merchants, a small price for peace of mind.

Best Practices for Keeping the Treasure Safe

- Good Data Hygiene: Regularly cleaning and organizing data to ensure it’s only accessible to those who truly need it.

- Serious Paperwork: Treating compliance documents and reports as if they’re part of the treasure itself.

- Smart Systems: Using technology that makes following the rules easier and safer.

Why Go Through All This Trouble?

The benefits of PCI compliance extend beyond avoiding fines. It’s about building a fortress of trust with customers, ensuring their data is as safe as the crown jewels.

By following the PCI DSS, businesses protect not just individual cardholders but the integrity of the entire payment system.

What Are the Key Components of PCI Compliance?

The journey towards PCI compliance is paved with specific, actionable steps designed to fortify a business’s defenses against data breaches and fraud. These components include:

- Implementing Strong Access Control Measures: Limiting access to cardholder data to only those individuals whose job requires such access ensures that sensitive information is not exposed to unnecessary risk.

- Maintaining a Vulnerability Management Program: Regularly updating antivirus software and developing secure systems and applications helps shield against attacks by cybercriminals.

- Regular Monitoring and Testing of Networks: Continuous tracking and monitoring of all access to network resources and cardholder data helps to identify and respond to vulnerabilities swiftly.

- Protecting Cardholder Data: Whether it’s stored or transmitted across public networks, encrypting cardholder data renders it unreadable and useless to malicious individuals.

How Do Businesses Achieve It?

Achieving PCI compliance is an ongoing process that requires continuous effort and vigilance. Here are steps businesses can take to ensure they remain on the right side of PCI DSS requirements:

- Conduct a Self-Assessment Questionnaire (SAQ): This is a tool provided by the PCI SSC to help businesses evaluate their compliance with PCI DSS standards.

- Undergo Regular PCI Scans: Using Approved Scanning Vendors (ASVs) to conduct vulnerability scans can help identify weaknesses in a network’s defenses.

- Engage with a Qualified Security Assessor (QSA): For businesses that handle a large volume of transactions, working with a QSA to perform an on-site PCI assessment can be invaluable.

- Develop a Remediation Plan: If gaps in compliance are identified, businesses must act promptly to address these issues and secure their environments.

- Submit Compliance Reports: Upon completing the assessment and remediation processes, businesses must submit relevant reports to their acquiring bank and card brands they work with.

Overcoming Challenges

While the path to PCI compliance may seem daunting, especially for small businesses with limited resources, overcoming these challenges is possible with a strategic approach. Here are a few tips:

- Leverage Technology Solutions: Many software and hardware solutions are designed to meet specific PCI DSS requirements, making it easier for businesses to secure their environments.

- Outsource Payment Processing: Smaller businesses might consider outsourcing their payment processing to third-party vendors who are already PCI compliant. This can significantly reduce the scope of PCI DSS requirements that the business needs to manage directly.

- Educate and Train Staff: Ensuring that all employees are aware of the importance of PCI compliance and how to handle cardholder data securely can prevent accidental breaches.

PCI Compliance can benefit merchants by reducing the risk of data breaches, fines, lawsuits, and reputational damage. It can also improve customer trust, loyalty, and satisfaction.

FAQs

Can a small business be exempt from PCI compliance?

No, all businesses that handle credit card information, regardless of size, must be PCI compliant.

How often do I need to renew PCI compliance?

PCI compliance must be renewed annually through self-assessment questionnaires, vulnerability scans, and possibly an on-site audit, depending on your business’s transaction volume.

Does PCI compliance apply to paper records as well?

Yes, PCI compliance covers all forms of cardholder data, including digital and paper records. Proper storage and disposal practices must be followed.

Can using a third-party payment processor make me automatically PCI compliant?

While using a third-party payment processor may reduce your scope of compliance, you are still responsible for ensuring that your operations meet PCI standards.

What happens if I only accept cash but store customer credit card information for other reasons?

If you store, process, or transmit any credit card information for any reason, you must be PCI compliant to protect that data.

Is there a difference between being compliant and being validated as compliant?

Yes, being compliant means you adhere to the PCI DSS standards, while being validated as compliant involves undergoing an assessment that verifies your adherence to those standards.

Final Words

PCI Compliance is not just a bunch of rules, as it’s a way of keeping your data safe, your customers happy, and your business healthy.

You don’t want to let the data breaches ruin your credit card transactions. No matter how big or small your business is, PCI compliance is not only a wise choice; it’s a must.