Financial anxiety can create constant worry about bills, debt, or the future. Feeling overwhelmed by money can affect decision-making, relationships, and overall health. Many people silently carry this burden, unsure how to move forward.

Small changes can bring powerful results. Clear steps can reduce fear and replace it with control. Money does not have to feel like a mystery or threat. Every person deserves confidence when dealing with finances.

This guide offers simple, direct actions that help reduce financial anxiety and build strong habits.

Table of Contents

ToggleLook at Your Money Without Flinching

Facing your financial situation directly is essential. Avoiding the reality of your finances can lead to increased stress and hinder your ability to make informed decisions.

Steps to Assess Your Financial Health

- Document All Income Sources: List your monthly income, including salary, bonuses, and any side earnings.

- Track Monthly Expenses: Record all expenditures, from fixed costs like rent or mortgage to variable expenses such as groceries and entertainment.

- Compile Outstanding Debts: Create a list of all debts, noting balances, interest rates, and minimum payments.

- Review Savings and Investments: Assess the total in your savings accounts, retirement funds, and other investments.

Insight

A 2023 survey revealed that 74 percent of Americans maintain a monthly budget, yet 84 percent of those admit to exceeding it occasionally.

If you want to learn more about personal finance and how to handle them, click here.

Sort Your Spending Before It Sinks You

Understanding and categorizing your spending habits can prevent financial pitfalls.

Common Spending Categories

- Necessities: Housing, utilities, groceries, transportation

- Savings and Investments: Retirement contributions, emergency funds, investment accounts

- Discretionary Spending: Dining out, entertainment, hobbies

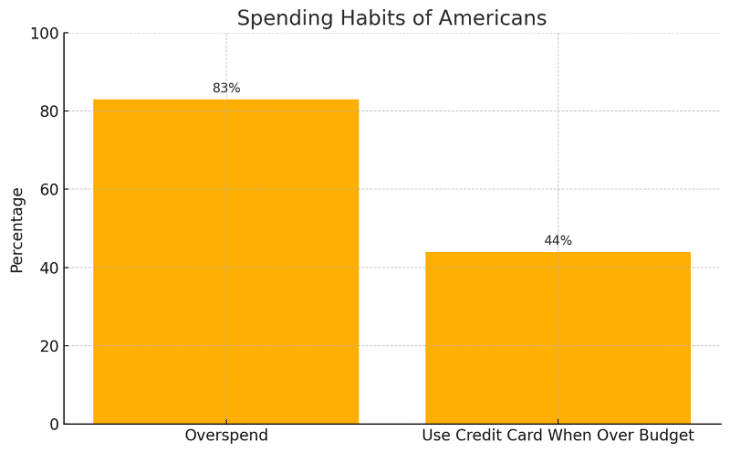

Statistic

83 percent of Americans admit to overspending. 44 percent use credit cards to cover extra purchases when they go over budget.

Make a Budget That Does Not Lie to You

Creating an honest and realistic budget builds stability. Most budgets fail because they are based on hope instead of facts.

Key Components of a Realistic Budget

- Accurate Income Projection: Use only your actual take-home pay

- Comprehensive Expense Tracking: Account for both regular and irregular expenses

- Flexibility: Include a buffer for unexpected costs

Budgeting Methods

| Method | Description |

| 50/30/20 Rule | 50 percent to needs, 30 percent to wants, 20 percent to savings and debt |

| Zero-Based Budget | Every dollar gets assigned to a purpose until nothing is left unplanned |

| Envelope System | Physical cash split into categories so you stop spending once empty |

Statistic

More than 8 in 10 Americans now budget. That marks a 16 percent increase over the past five years.

Save Something, No Matter How Small

You do not need a big income to start saving. Small, steady amounts matter more than rare, large deposits.

Strategies to Start Saving

- Automate Savings: Set automatic transfers to your savings account on payday

- Start Small: Even 10 dollars a week builds momentum and habit

- Cut Waste: Cancel unused subscriptions or trim food delivery expenses

Insight

On average, Americans saved 6.4 percent of their income in 2022. Yet nearly 30 percent saved nothing.

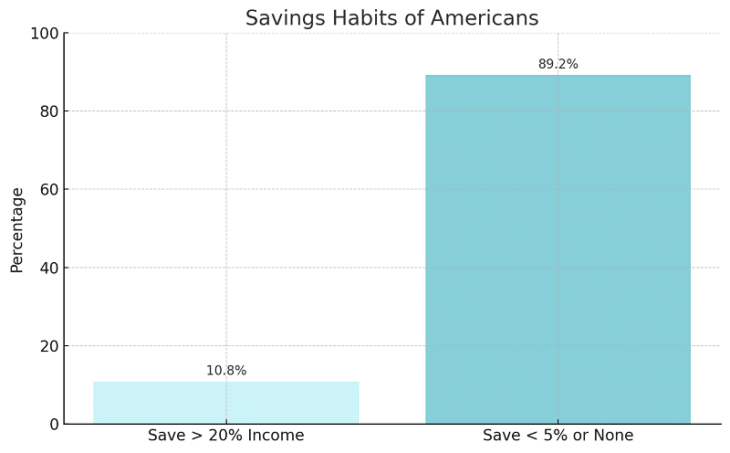

Statistic

Only 10.8 percent of Americans save more than 20 percent of their income. Most save under 5 percent or nothing at all.

Stop Letting Debt Boss You Around

Debt does not disappear by ignoring it. Interest adds pressure every day you delay.

Types of Debt to Prioritize

- High-interest debt: Credit cards often carry rates above 20 percent

- Variable-rate debt: Loans with changing interest can become more expensive over time

- Small nuisance debts: Clearing small balances gives mental relief and simplifies your budget

Repayment Methods

| Strategy | How It Works | Best For |

| Avalanche | Pay extra on the highest interest rate first | Saving most money long term |

| Snowball | Pay extra on the smallest balance first | Building motivation early |

Track Your Money Like It Owes You Answers

People lose thousands each year through unnoticed fees, duplicate charges, or untracked subscriptions.

What to Monitor Weekly

- Account balances

- New charges

- Unexpected fees

- Pending subscriptions

- Cash withdrawals

Learn What Actually Matters With Money

Most people were never taught real personal finance. The basics still outperform complex tricks.

Essential Concepts Everyone Needs

- Compound interest: Makes both debt and savings grow faster over time

- Inflation awareness: Affects buying power and long-term savings goals

- Emergency planning: Prevents setbacks from turning into disasters

Pay Special Attention To

- Budgeting

- Debt payoff strategies

- Saving structure

- Credit basics

- Long-term investing

Quit Copying Other People’s Goals

Your money plan must match your values, not someone else’s lifestyle.

Common Traps to Avoid

- Mimicking friends who earn more

- Chasing what influencers promote

- Letting someone else define your success

Build Personal Goals Around

- Your real income

- Your family situation

- Your long-term needs

Over 40 percent of Americans admit they have made purchases to match peers even when they could not afford them.

Do Not Let Fear Make Your Decisions

Fear leads to avoidance, procrastination, and rash spending. Decisions rooted in panic cause more damage than the original problem.

Signs That Fear Is Controlling Your Finances

- Avoiding bank statements or credit reports

- Ignoring overdue bills

- Making purchases to feel better emotionally

- Freezing instead of taking small actions

Shift the Focus

- Look at one account at a time

- Take one small step each day

- Set timers to limit how long you think about money issues

Get Real Help When You Need It

Money problems are personal, but you do not have to face them alone. Expert advice saves time, avoids mistakes, and gives fresh perspective.

Who to Talk To

| Type | What They Offer |

| Certified Financial Counselor | Help with budgets, credit repair, debt strategy |

| Fee-only Financial Advisor | Personalized long-term planning, no sales agenda |

| Nonprofit Credit Agency | Debt management plans and credit counseling |

Warning Signs You Need Support

- Making minimum payments only

- Using one credit card to pay another

- Borrowing money for essentials

- Feeling ashamed or stuck

FAQs

How much should I keep in cash at home?

Keep $300 to $500 max in a safe spot. Only for real emergencies like power outages or banking issues. Too much cash at home increases risk of theft or loss.

Can I pause debt payments temporarily without damage?

Yes, but only with a formal agreement. Call your lender and ask about deferment or forbearance options. Missing payments without notice damages your credit fast.

How do I avoid overdraft fees completely?

Turn off overdraft protection at your bank. Set balance alerts on your phone. Always keep a $50 cushion if possible. Check your account before every payment or purchase.

What is the safest way to save without using a regular bank?

Use a federally insured credit union. You can also use a prepaid debit card with savings features if you do not qualify for a bank account. Always check that funds are insured up to $250,000.

Last Words

Financial anxiety feeds on confusion, shame, and silence. You break that cycle by facing the numbers, building small wins, and doing the work even when it feels pointless. No one builds confidence through perfection. Confidence grows by staying in the fight.

You do not need to be rich. You need to be in control.